Brokers also can benefit from IBKR’s clear pricing model and the ability to access interbank spreads with out markups, which may be especially engaging to professional merchants and establishments. The Foreign Exchange (Forex) market is the world’s largest and most liquid financial market, with an estimated $7.5 trillion in day by day trading volume. As the Forex trade expands, extra firms seek to enter the market and provide their own Forex trading platforms.

Their Forex liquidity options include competitive buying and selling prices spreads starting from nearly zero, margin requirements set at simply 1% and execution velocity ranging from 12ms. X Open Hub provides its purchasers a extensive range of buying and selling instruments, including 60+ currency pairs, majors, minors, and exotics. The platform is cloud-based, with no hosting costs, and designed for speedy and high-quality execution. X Open Hub presents ultra-fast feeds and execution by way of varied connectivity options corresponding to FIX 4.three, FIX 4.4, xAPI, MT4/MT5 Gateways, or Bridge Providers.

A white label in forex is an associates program, according to which an answer and infrastructure supplier transfers it on a paid foundation to the founder of a new brokerage firm. Forex trading has turn into increasingly in style through the years, with more and more people and businesses seeking to profit from the fluctuations in world currency trade rates. However, coming into the foreign exchange market as a broker can be a daunting task, as it requires intensive knowledge of the market, technological infrastructure, and regulatory compliance. However, it is necessary to fastidiously think about the choice of the established dealer and ensure they have a reliable and sturdy trading infrastructure. Additionally, complying with the regulatory necessities is essential to working a reliable and trustworthy foreign currency trading business.

It is an all-in-one reasonably priced brokerage package deal designed to help individuals launch their fully-branded Forex/CFD/Crypto brokerage. With SmartStart, Leverate supplies a complete resolution that includes all the mandatory instruments and sources to construct a profitable brokerage from the bottom up. B2Broker is a global firm founded in 2014 that assists brokerages and exchange corporations in reaching their enterprise goals.

Packages

It is necessary to contemplate components similar to reliability, functionality, person experience, compatibility, integration capabilities, technical support, and price. By fastidiously evaluating these components, brokers can choose a platform that meets their specific necessities and supplies their purchasers with a seamless and efficient trading expertise. Founded in 2014, Tickmill has quickly established a popularity as a dependable and clear provider of technology-focused trading products. The platform offers access to varied markets with competitive spreads, speedy executions, and superior instruments for technical analysis. Tickmill’s white label resolution grants brokers the pliability to customise the platform according to their clients’ wants.

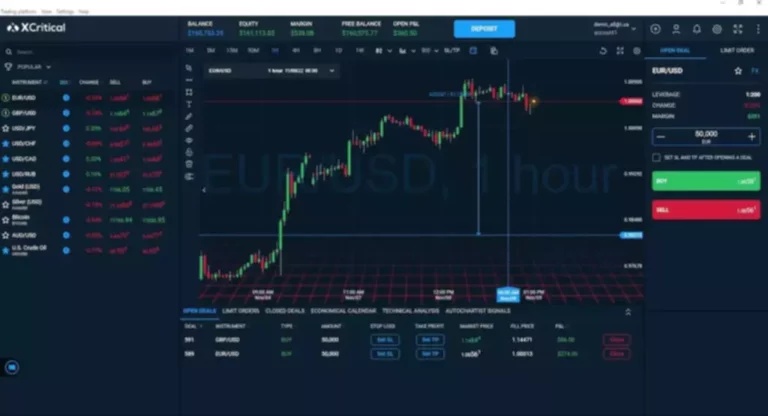

When integrated into white labeling, the platform’s options and benefits are still obtainable to the broker’s clients, however with the added benefit of having the broker’s model entrance and middle. A Forex White Label supplier offering The TickTrader Trading Platform, along with multi-level liquidity, useful back-office, and other instruments, to simplify the journey of a startup brokerage. Our evaluation has highlighted the top performers on this house, with Interactive Brokers, Saxo Bank, Stock Republic, ETNA, and CMC Connect rising because the main choices. Each of these platforms provides a distinct set of options and advantages, catering to numerous enterprise needs and requirements.

Additionally, white labeling helps in building model recognition and might improve the broker’s status as a trusted supplier of foreign forex trading services. Interactive Brokers (IBKR) provides a white label program for Forex brokers, which permits them to leverage IBKR’s technology and infrastructure to create a branded buying and selling platform for his or her clients. IBKR’s white label program significantly benefits Forex brokers who need to increase their offering beyond Forex and into different asset lessons, corresponding to equities, futures, and choices.

Introducing Broker And White Label: What Is The Difference?

The white label program permits the third-party entity to supply foreign foreign money trading providers under its personal model, using the infrastructure and assets of the established brokerage. For the established foreign exchange dealer, white labeling permits them to increase their market reach and increase their shopper base without the need for extensive advertising efforts. It also supplies an additional income stream through the fees and commissions charged to the white label companions.

This permits the white label firm to supply foreign currency trading providers with out having to develop their very own buying and selling infrastructure. Soft-FX offers the Forex Broker Turnkey answer as a one-stop portal to enter the FX business market. This complete solution supplies the mandatory instruments for a Forex brokerage with a dependable software basis, multi-layered liquidity, robust buying and selling platform, and a convenient again workplace.

What’s A White Label Forex Broker?

Usually, for individual IBs, they must be already affiliated with a dealer firm earlier than they apply. For instance, within the US, an applicant must be registered as an FCM, CTA, or IB with the NFA (National Future Association) to work as an IB. To clear up our personal problem, we created a website that helps investors find, be taught and evaluate the different platforms to avoid wasting and make investments online.

Nation’s Largest Minority and Woman-Owned Brokerage Joins Real – Yahoo Canada Finance

Nation’s Largest Minority and Woman-Owned Brokerage Joins Real.

Posted: Wed, 01 May 2024 07:00:00 GMT [source]

They offer a sturdy platform with superior buying and selling know-how that appeals to experienced traders and traders. With low margin charges and tight spreads, they attempt to supply their purchasers with competitive pricing. A white label program, in the context of foreign currency trading, refers to a partnership between a longtime forex brokerage and a third-party entity, typically a model new broker or monetary establishment.

How Do Forex White Label Solution Suppliers Work?

The solution delivery and installation course of can be accomplished inside a quick timeframe of just 2 weeks. Additionally, you can make use of a hybrid business mannequin that combines A-Booking and B-Booking to maximise the revenue potential of your brokerage. This contains real-time market knowledge, charting instruments, technical indicators, and risk management tools. A complete set of buying and selling instruments is essential for merchants to research the markets, make knowledgeable trading decisions, and handle their threat successfully. The platform should also support multiple order varieties and execution methods to cater to completely different buying and selling methods.

Others, however, are fairly relaxed, promoting progress, but in addition exposing brokerage platforms to a complete myriad of dangers. It is mostly suggested to discover a provider that’s registered in a jurisdiction that has a certain diploma of regulation that protects your platform, however isn’t too strict to a point where it stifles progress. For the third get together, going for a white label answer is commonly more cost-effective than building a buying and selling platform from scratch. We are a premium dealer solutions supplier, dedicated to delivering a broad array of innovative solutions and services that enable Forex brokers and financial establishments to minimize threat and maximize development. In reality, changing into an IB is a much less complicated and extra hassle-free approach to begin earning commissions and delivering traffic to the main dealer.

A white label foreign exchange dealer is an organization that gives foreign foreign money trading providers, however as an alternative of making their own platform, they use a platform provided by another company. In this article, we will explore what white label foreign exchange brokers are, how they work, and their advantages and disadvantages. When a dealer decides to turn out to be a white label partner, they enter into an settlement https://www.xcritical.com/ with an established foreign exchange broker who offers them with a branded buying and selling platform and different needed instruments. The white label partner is liable for attracting purchasers and providing customer help, whereas the established forex broker handles the back-end operations, together with liquidity provision, trade execution, and danger administration.

Brokers who are the first to offer revolutionary options to widespread pains quickly rise to market leaders. At TFB, we offer custom improvement options, so when you have any ideas, we would be pleased that can help you deliver it to life. Most brokers apply a hybrid (both A- and B-book) mannequin to limit their dangers and maximize profits at the similar time. Many brokers begin what does ecn mean in forex with offshore jurisdictions as these are sometimes easier and cheaper to operate in. Another simple approach to decide a dependable, good dealer can be to adjust the specifications to your want. For that particular cause, we create the broker finder that will assist you customise your buying and selling needs and discover the brokers that fit your standard.

Elements To Consider When Selecting A White Label Trading & Funding Platforms Platform

Stock Republic is a software program company that provides white label social trading platforms for financial institutions. Op-tier banks have used the platform in 5 different markets, with hundreds of users, together with well-known European investing and buying and selling platforms such as Interactive Investor and Comdirect. Their answer is totally customisable, allowing you to construct a profitable platform that aligns together with your brand and caters to your particular requirements and preferences. This degree of customisation ensures that customers have a novel and personalised trading expertise. White label offers forex brokers with companies and solutions to help the wants of brokerage corporations. In addition to the options mentioned earlier, Soft-FX’s Forex Broker Turnkey answer supplies further advantages that may aid in the successful launch of your brokerage business.

Your monetary budgeting is individual, set to alter, and ought to be negotiated with the company you’re set on working with. Established in 1999, they provide competitive pricing, sturdy trading tools and premium assets accompanied by excellent customer assist. FXCM makes buying and selling simple with its easy-to-use forex trading platforms, together with the popular MetaTrader four (MT4) and the company’s personal proprietary platform, Trading Station. In the fast-paced world of foreign forex trading, having the right instruments and technology is crucial for achievement. This article will explore the key factors to contemplate when choosing the right white label foreign currency trading platform on your brokerage. Interactive Brokers is a broadly known brokerage firm that gives trading companies for forex, stocks, choices, futures, and other monetary instruments.